As the physical and economic harms of climate change accumulate, corporate managers have faced increasing pressure to reduce their companies’ greenhouse gas emissions and adapt their businesses to climate-related risks. In parallel, civil society organizations and activist investors have increasingly sought to compel private sector action on climate change, while […]

Cynthia Hanawalt

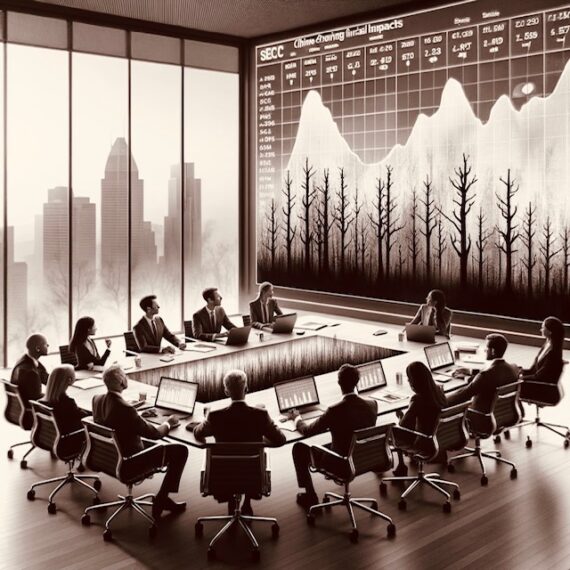

What will happen to the SEC’s March 2024 climate disclosure rule under the new federal administration? A paper published by Columbia University’s Sabin Center for Climate Change Law and the Columbia Center on Sustainable Investment (CCSI) seeks to contribute to the upcoming debates on this question. In their joint report, […]

The Republican-led “anti-ESG” (environmental, social, governance) movement over the last two years has largely been a legislative effort, comprised primarily of state-level bills that attempt to halt the consideration of climate risk and other commonplace factors in investment decisions connected with government funds, contracts, and pensions. Hundreds of these proposals […]

Though it has been largely ignored by the healthcare industry thus far, and unmentioned by Department of Health and Human Services (HHS), the Securities and Exchange Commission’s (SEC) climate disclosure rule may prove to be one of the most consequential healthcare regulations in US history. Healthcare investors are particularly interested […]

Today, the Sabin Center for Climate Change Law and the Columbia Center on Sustainable Investment jointly published a new report: Recommendations to Update the FTC and DOJ’s Guidelines for Collaboration Among Competitors. The guidelines help firms understand the antitrust principles and boundaries of any collaborations they may undertake with other […]

Now that the Securities and Exchange Commission (SEC) has released its final climate disclosure rule, attention has turned to the rule’s implementation and impact. This post is the third in a series of blogs that address specific legal features of the rule: Part One offers a summary of the final […]

In the March 6th vote to approve the SEC’s final climate disclosure rule, the Commissioners split along party lines, with the rule passing by a 3-2 vote. It received a scathing review from Commissioners Peirce and Uyeda, both of whom suggested that the SEC should have re-proposed a new rule, […]

Nearly two years and 24,000 public comments after its proposal, the Securities and Exchange Commission (SEC) released its final climate disclosure rule last week, formally titled “The Enhancement and Standardization of Climate-Related Disclosures for Investors.” The rule expands public companies’ disclosure requirements to include certain greenhouse gas (GHG) emissions data […]